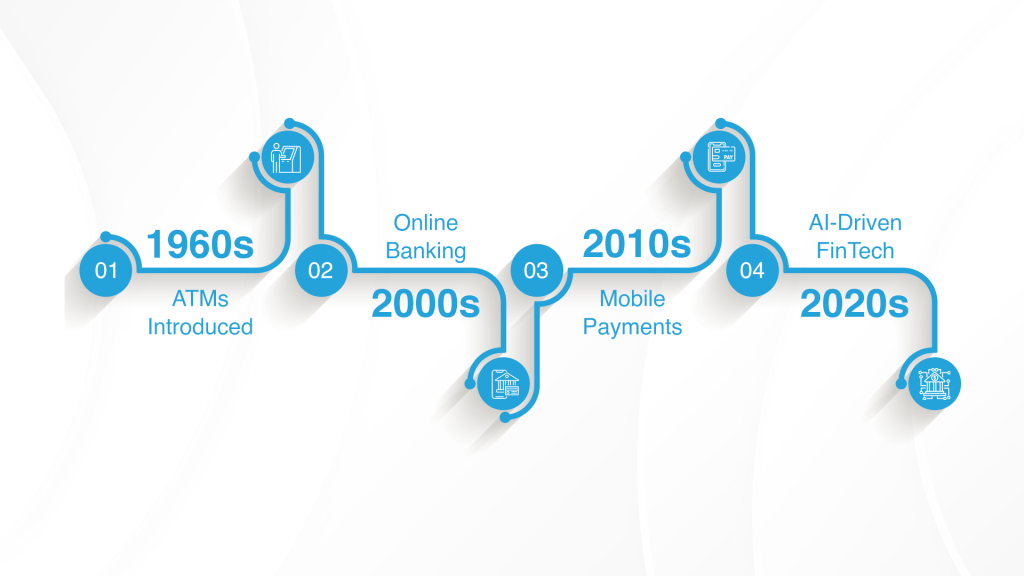

When ATMs were introduced in the 1960s who would have thought there’d be a time we would be sending money via mobile phones and the concept of cash in hand would seem alien.

As we speak, the fusion of AI and FinTech powered by machine learning, AI assistants, and risk analytics has marked a new era of financial services marked by intelligence and automation. All these advancements have ultimately led to customer satisfaction.

Why AI and FinTech Matter Now?

- The global fintech market is projected to reach roughly $395 billion in 2025.

- The AI in FinTech segment has no leashes on and it is expected to hit $60.6 billion by 2033.

- If we only look at the United States, its very own AI-driven FinTech market is projected to rise to a whopping figure of $9.36 billion by 2030.

These figures confirm the crucial importance of AI and FinTech in order to achieve innovation and a significantly competitive advantage in finance.

Artificial Intelligence Companies in Finance are Leading Transformation

- Zest AI improves underwriting accuracy and reduces losses by ~25%

- Feedzai detects real-time fraud and serves enterprise clients globally

- Startups like Clerkie, Casca, and Brico are automating debt management, loan origination, and licensing—showing the power of ai for fintech

- Giants like Microsoft, IBM, Google, AWS, and Salesforce support financial institutions with AI platforms

These artificial intelligence companies in finance have a purpose to serve: They’re enabling more accurate risk assessment, faster customer service, and smarter investment allocations.

How Fintech and AI are Revolutionizing Financial Services?

Let’s have a quick look at how fintech and AI combine to transform key areas:

- Fraud Detection & Risk Management

Real-time monitoring by platforms like PayPal, Stripe, and Feedzai identifies fraudulent transactions instantly and saves one from a huge deal of stress.

- Credit Scoring & Lending

Tools like Zest AI and Upstart use alternative datasets—education, employment—to include underserved borrowers and reduce defaults

- Virtual Advisors & Chatbots

GenAI-powered assistants such as Arta Finance offer investment advice in conversational tone (e.g., Gen Z slang)

- Contract Automation & Compliance

GenAI drafts and reviews legal documents, saving up to 70% in contract processing time

- Personalized Financial Insights

Firms like Personetics use AI for bespoke notifications—e.g., suggesting savings goals or managing cash flow

Why AI for FinTech Unlocks New Opportunities You Never Heard Of:

- Automation & cost reduction: GenAI accelerates workflows and lowers operational costs and your budget ends up being tamed.

- Enhanced decision-making: Supervised & unsupervised learning improves risk modeling and portfolio optimization.

- Customer experience: Personalization boosts engagement; chatbots reduce wait times and labor costs.

- Regulatory compliance: AI-powered analysis helps automate transaction monitoring and draft filings with better accuracy

Together, the synergy of AI and fintech enables smarter, faster, safer, and more tailored finance.

Addressing Risks Like Governance, Ethics & Security

There is no doubt that Rapid AI adoption comes with risks—and we can’t go without managing them with precision.

- Cybersecurity threats: These threats are becoming prevalent. AI bots can be hijacked for phishing or data attacks and cause immense damage.

- Bias & fairness: Financial models must be audited. This is important to avoid discrimination on the basis of religion or gender.

- Explainability: Decisions based on AI need to be transparent. It helps in building a trust level with customers.

- Regulatory sandboxes: Dynamic frameworks encourage safe innovation without legal constraints so you breathe in peace.

A balanced approach ensures AI and FinTech drive growth responsibly.

What Does the Future Look Like: From Insight to Autonomy

- GenAI advisors will offer financial planning, budgeting, and chat support in natural language.

- Algorithmic trading across hedge funds and wealth managers (JPMorgan, Goldman Sachs) will use AI for faster, smarter trades.

- Embedded finance and DeFi: AI enables seamless flow of lending, payments, and analytics inside apps. It is made possible via decentralized platforms .

All thanks to AI and Fintech this shift will make finance more proactive, predictive, and integrated.

Conclusion: Embrace the Future with AI and FinTech

Innovation has always impacted our lives- in a good way! Today it is changing the way we use money. AI and Fintech are pushing finance to enter an era of intelligent automation. The future looks bright with boosted efficiency and enhanced customer satisfaction.

We have results and proven facts. All these real-world success stories and major players actively deploying AI show that organizations are more than ready to embrace AI and fintech and pave the way for more success stories.

Everyone’s goal is to stay ahead of the game. We believe you want that for yourself as well. Don’t look back. This is your time to explore AI for FinTech.

Work with OCloud Solutions– One of the leading artificial intelligence companies in finance, that seizes the promise of fintech and AI.